Introducing Your New Wealth Management Partner.

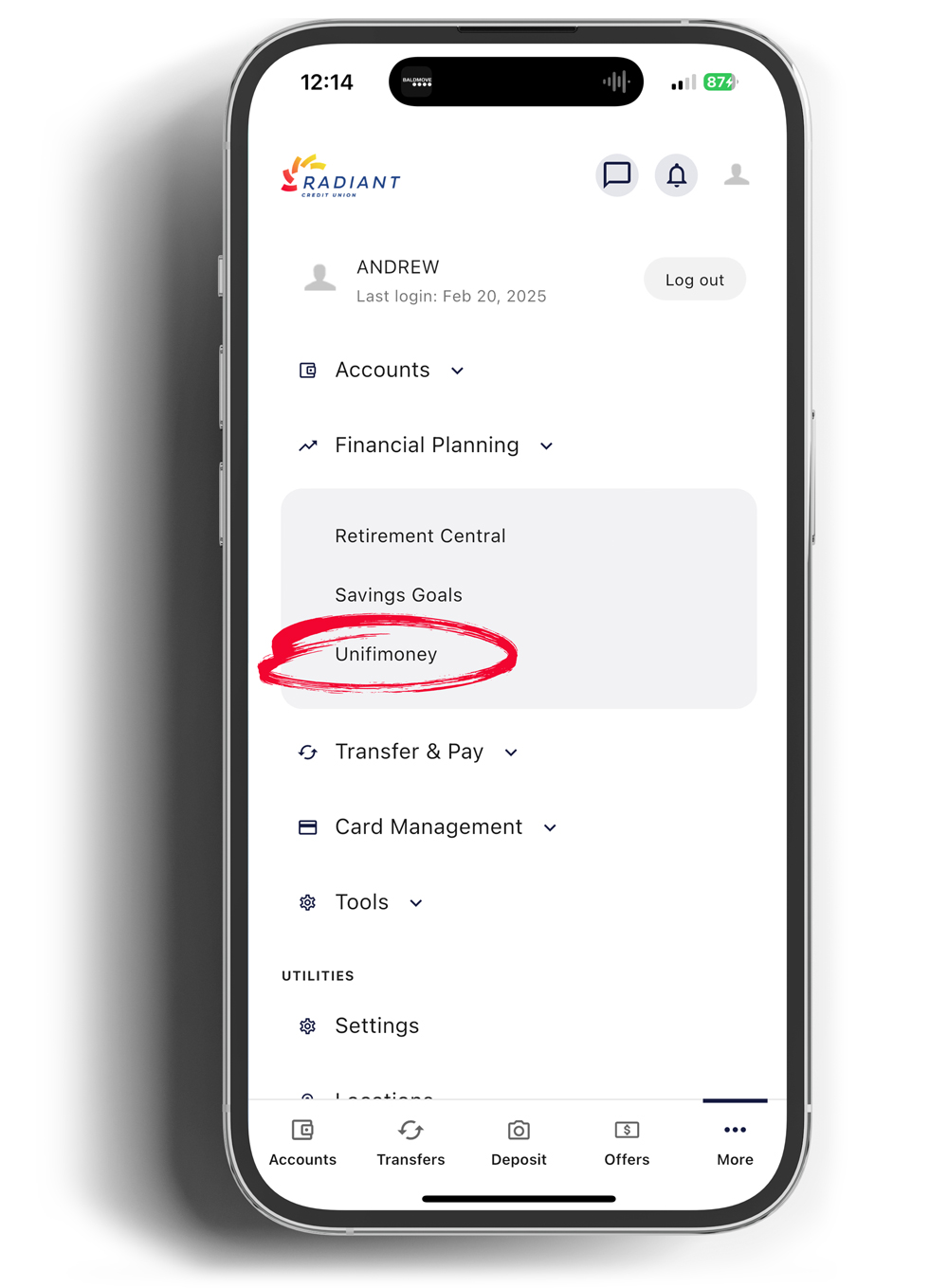

Enjoy a world of digital investment possibilities - right in the Radiant Credit Union app with our partner Unifimoney.

Invest the Way You Want

At Radiant Credit Union, our main goal is to help you achieve your financial goals. We work hard to offer innovative products and services designed to fit your banking needs, and it all starts with our digital banking solutions.

That's why we're thrilled to tell you that we've added Unifimoney, a user-friendly digital wealth platform, now available through our online and mobile banking. With Unifimoney, you have access to a range of self-directed investment services, including a diverse variety of EFTs, digital assets, retirement accounts, precious metals, equities, and much more.

No downloads required. Simply create a Unifimoney account and start building your financial future today.

Get Started

Simplified Investing and Money Management

Unifimoney from Radiant Credit Union gives you a seamless solution that ties together your banking and investing, making it easier than ever to manage and grow your money.

Whether you're buying stocks, investing in precious metals, or using our Robo platform for passive investing, you'll have a wide variety of easy-to-use digital wealth management tools all within our banking app.

No Downloads Required!

Create a Unifimoney account to get started, and have fun building your financial future today.

Get Started

Getting Started with Unifimoney

Welcome to Unifimoney! Below is a step-by-step guide to help Radiant members enroll and set up their investment accounts with ease. Here you’ll find key details on what information you’ll need and what to expect during the process.

Step 1: Review Terms and Conditions

Before proceeding with enrollment, members will be required to review and accept Unifimoney’s Terms and Conditions. This includes legal agreements related to account usage, electronic signatures, and investment advisory services.

What You’ll Need:

- Review the legal disclosures provided during sign-up.

- Consent to electronic signatures and records.

Step 2: Provide member Profile Information

Members will be asked to enter personal details to create their profile.

What You’ll Need:

- Full name

- Date of birth

- Social Security Number (SSN) or Tax Identification Number (TIN)

- Contact information (email, phone number, and address)

Step 3: Employment Details

To comply with financial regulations, Unifimoney requires basic employment information.

What You’ll Need:

- Employer name

- Occupation

- Employment status

Step 4: Choose Account Type(s) to Open

Members will select the type of financial account(s) they want to open with Unifimoney.

Options Available:

- Investment Accounts

- Robo and/or Self Elected

- Default accounts:

- Cryptocurrency Account

- Precious Metals Account

Step 5: Select Investment Strategy (Robo or Self-Directed)

Members can opt for automated investing (robo-advisory) or self-directed investing.

Options Available:

- Robo-advisory (automated investment based on risk profile)

- Self-directed (choose and manage investments manually)

Step 6: Complete the Risk Tolerance Questionnaire

To tailor investment recommendations, Unifimoney will ask members questions about their risk tolerance and financial goals.

What You’ll Need:

- Understanding of their financial objectives

- Comfort level with investment risk

Step 7: Review Risk Tolerance/Investment Objective Recommendation

Based on their responses, Unifimoney will provide an investment strategy recommendation.

What to Expect:

- Recommended portfolio allocation (Conservative, Moderate, or Aggressive)

- Ability to adjust or confirm investment preferences

Step 8: Set Up Recurring Investment/Deposit

To automate savings and investing, members will have the option to set up recurring deposits.

What You’ll Need:

- Bank account details for funding

- Preferred deposit amount and frequency

Step 9: Submit Account for Approval

Once all information is provided, members will review their details and submit their application.

What to Expect:

- Verification process (may require additional identity documentation if member information cannot be verified)

- Approval notification via email

- Next steps for account funding and investing

Get Started

Next Steps After their account is approved, members can begin funding it and start investing based on their selected strategy. For any questions, they can visit Unifimoney’s Help Center or contact support.

Unifimoney Tech QOBZ, LLC and Radiant Credit Union are not affiliated.

Investing involves risk, including possible loss of principal. Investment advisory services are provided by Unifimoney RIA, QOBZ, LLC, an SEC-registered investment advisor. For important information and disclosures relating to the robo-investment account, visit https://www.unifimoney.com/legal . Brokerage services are offered through APEX Clearing and Custody, a registered broker dealer, member of FINRA and SIPC. Your cash and investments are protected by SIPC up to $500,000, with a limit of $250,000 for cash. APEX Clearing and Custody is SOCII type 1, GDPR and CCPA compliant. Registered in all 50 U.S. states. You can check the background of this firm on FINRA’s BrokerCheck. Cryptocurrency trading is offered through GEMINI, a digital asset platform operated by and proprietary to Gemini Trust Company, LLC, a New York trust company. Precious Metal trading is offered through GBI, a New-York-based precious metals dealer. Investment products are not NCUA Insured – No Credit Union Guarantee – May Lose Value.

* Unifimoney does not charge a commission on self-elected trading. However, other charges may apply